Over 10 years experience of Traceability Solutions

By pharmatrax

Category: Technoloy

No Comments

No Comments

Firms ramping up innovation efforts in new sectors like high-quality drugs and biologics

As China moves forward from being the world’s manufacturing powerhouse to an innovation-driven economy focusing on high-quality development, the innovation capabilities of Chinese pharmaceutical companies have been growing steadily, reflected by the rapid development of domestic biologics and innovative medicine sector, industry people said.

According to the Center for Drug Evaluation under China’s National Medical Products Administration, it granted approvals for 91 drugs with priority review status in the first half of this year, among which, 65 were domestic drugs while 26 were imported.

In fact, clinical trial and market approval applications for high-quality biologics and innovative drugs have been increasing in China.

Last year, the CDE accepted 448 registration applications for 222 domestically developed Class-1 new innovative drugs, while the figures for 2017 were 402 and 181. Class-1 new drugs refer to drugs that have never been marketed in China or overseas, and innovative drugs means drugs with independent intellectual property rights.

Among all the applications in 2018, 403 applications were for 198 drugs’ clinical trial approvals, and 45 were for market approval for 24 drugs, while in 2017, 379 applications were for clinical trial approvals, involving 171 drugs, and 23 applications were for market approval, involving 10 drugs.

In 2018, 323 applications were for 115 chemical drugs, and 123 were for 106 biologics, while in 2017, 324 applications were for 112 chemical drugs and 76 applications were for 68 biologics.

Song Ruilin, executive president of the China Pharmaceutical Innovation and Research Development Association, said Chinese pharmaceutical companies have made remarkable progress in innovative drug research and development in the past few years, especially in the area of biologics, thanks to their focus on innovation and homegrown R&D.

“In terms of pharmaceutical innovation, where we are now is completely different from where we were 15 years ago,” he said.

“Chinese companies used to focus on generics, but now they have been building up R&D capabilities and many invest generously in innovative drugs.”

From 1949 to 2008, less than five domestically developed drugs were approved by Chinese authorities, while from 2008 to 2018, the number increased by about 10 times to about 40, according to Song.

In 2018, nine Class-1 new drugs developed by domestic pharmaceutical companies were approved in China, figures from the National Medical Products Administration showed.

Most of the nine new drugs are treatments for cancer or rare diseases, or anti-virus therapies that are urgently needed in medical practice, according to the National Medical Products Administration.

Shi Lichen, founder of Beijing Dingchen Medical Consultancy, said Chinese pharmaceutical companies still lag multinationals in the sector of chemical pharmaceuticals despite that they are picking up speed. But it is different in the development of biologics and innovative drugs.

Domestic companies have showed world-leading capabilities in many biomedical sectors, including vaccines, gene testing, and immunity therapies, he added.

One milestone was the launch of several homegrown anti-PD-1 treatments. Anti-PD-1 treatment is an emerging therapy that boosts the immune system to help the body to target and kill tumors.

In May 2019, an anti-PD-1 medicine developed by Hengrui Medicine Co Ltd got approval from the National Medical Products Administration for treating Hodgkin lymphoma, becoming China’s third homegrown PD-1 treatment.

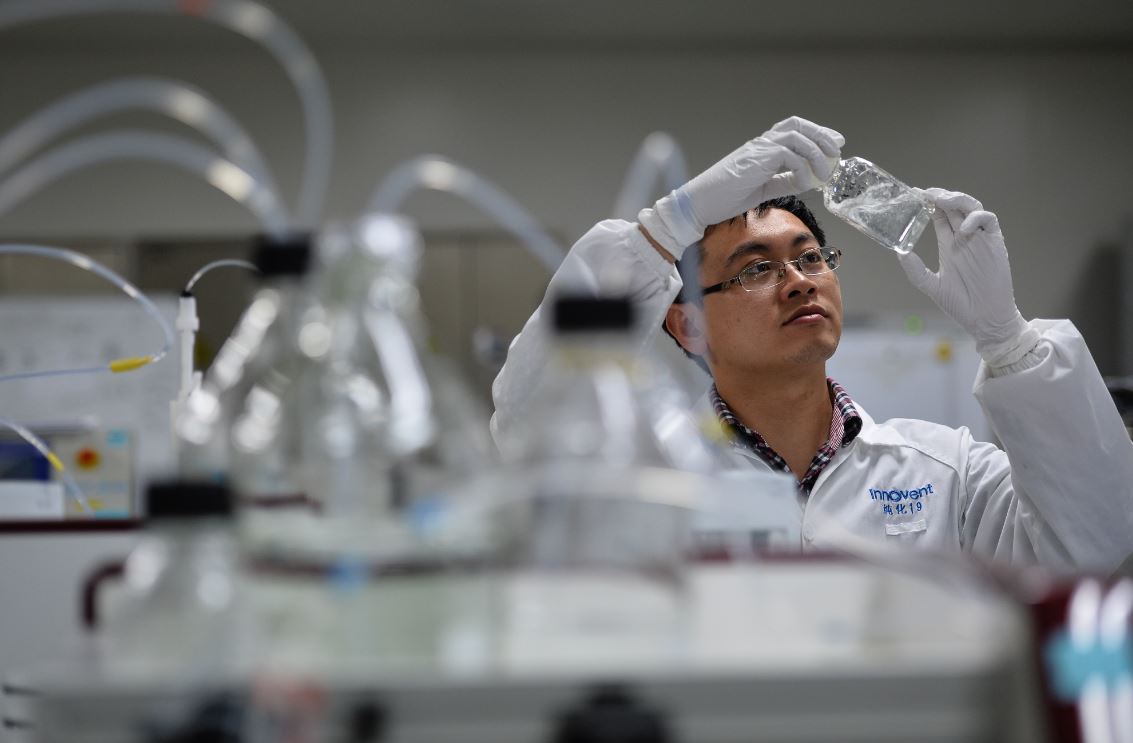

In December 2018, China’s first homegrown PD-1 treatment, developed by Shanghai Junshi Biosciences Co Ltd, was conditionally approved by the administration under priority review for treating skin cancer melanoma, followed by the approval of another PD-1 medicine a few days later for treating Hodgkin lymphoma, which was developed by Innovent Biologics Inc.

The two drugs were approved as foreign anti-PD-1 treatments six months later.

Another example was Fosun Pharma’s holding subsidiary Shanghai Henlius Biotech Inc’s biosimilar version of a popular biologic original for lymphoma treatment by Roche.

Approved in February 2019, the drug is China’s first-ever biosimilar.

Chen Qiulin, deputy director of the Health Industry Development Research Center at the Chinese Academy of Social Sciences, observed Chinese pharmaceutical companies now pay increasing attention to innovation and R&D, because the domestic pharmaceutical market has been changing focus to high-quality and cost-effective drugs, instead of low-end and cheap generics, and innovation brings about better returns in the long term.

The development gap between Chinese and multinational pharmaceutical firms is smaller in the biomedical sector compared to that in chemical medicine, and breakthroughs in biologics are like a steppingstone for Chinese companies to have stronger competence against multinationals in biomedicine and chemical drugs, he said.

In an article published on Henlius Biotech’s WeChat account, Scott Liu, the company’s president, CEO and co-founder, said biologics are structurally complex large molecules produced in living cells and more difficult to characterize than chemically synthesized small-molecule drugs.

The biological processes are variable and highly sensitive to manufacturing conditions, and changes to any step of the production process may alter the structure, biological activity, effectiveness and safety of the biologics, he said, adding it takes good techniques to keep the bioequivalence.

Source: http://global.chinadaily.com.cn/a/201907/26/WS5d3a5726a310d830564011e4.html